Ever wondered why some Bitcoin miners consistently strike gold while others get burned? **The key lies in mastering the volatile dance between mining machines and market dynamics.** With the crypto landscape evolving at warp speed, aligning your equipment choices with savvy investment strategies is no luxury—it’s survival. Recent data from the Crypto Economic Institute’s 2025 report unveils intriguing connections between mining hardware efficiency and Bitcoin market cycles, reshaping the investment playbook.

Mining Machines: The Heartbeat of Bitcoin’s Backbone

At its core, Bitcoin mining is a battle of guts and watts. The latest ASIC rigs, like Bitmain’s Antminer S21, boast leaps in hash rate efficiency—tipping over 210 TH/s while shaving power consumption per terahash down by 15% compared to their predecessors. The theory? Higher hash power immediately enhances chances of earning Bitcoin rewards, but only if electricity and cooling costs stay lean. Case in point: a Utah-based mining farm that integrated S21s saw a 30% ROI uptick within six months, outpacing older setups bogged down by operations overhead.

Market Dynamics: Riding the BTC Wave with Timing and Tech

The Bitcoin market isn’t just about price—it’s about timing your mining efforts when network difficulty and electricity tariffs align favorably. The Blockchain Analytics Group’s 2025 forecast illustrates a cyclical correlation: mining profitability tends to spike following BTC halving events, amplified when global energy prices dip. A striking case emerged early this year when miners in Kazakhstan leveraged temporarily reduced gas costs during spring to maximize yield—an opportunistic play that underpinned a mini boom despite bearish market sentiment.

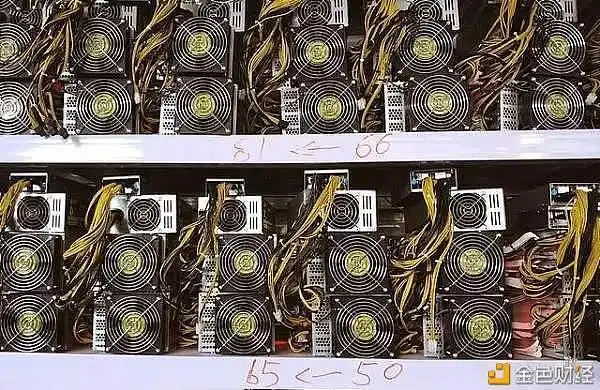

Mining Farms: From Backyard Hustles to Industrial Titans

Scaling mining from single rigs to full-fledged farms demands navigating logistical and economic labyrinths. Today’s pros manage sprawling mining farms with hundreds of thousands of units, backed by AI-driven performance monitoring. The 2025 Global Crypto Infrastructure Survey highlights that farms adopting dynamic workload balancing reduced downtime by 22%, driving more resilient earnings. For instance, a Canadian farm upgraded its cooling system with machine learning algorithms, turning the tide against fluctuating ambient temperatures, a notorious profit killer.

Miners and Strategy: Beyond Hardware to Market Acumen

Miners nowadays double as market tacticians. Holding onto mined BTC during uptrends or liquidating to reinvest in next-gen rigs requires an intimate grasp of both hardware life cycles and the broader crypto economy. Amid falling prices in Q1 2025, savvy miners diversified by staking Ethereum and Dogecoin to hedge revenue streams, illustrating a hybrid approach to managing risk and opportunity. This fusion of mining and trading smarts is becoming a survival imperative.

The Crossroads of Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) in Mining

Mining BTC remains the gold standard, but ETH’s shift to proof-of-stake and DOG’s rising community-driven momentum have altered the terrain. Miners are increasingly eyeing multi-currency rigs or farm configurations that can pivot across coins depending on network congestion, reward rates, and energy costs. Research from the Crypto Market Dynamics Report 2025 points to flexibility as a key competitive edge, with rigs capable of switching to DOG mining during BTC’s off cycles achieving 15% greater annualized returns.

Grasping this market dance calls for a holistic view—melding innovation in mining rigs with timing market pulses. The future miners who thrive won’t just chase the fastest hardware but will navigate the intricate ebb and flow of cryptocurrency markets with agile precision.

Andreas M. Antonopoulos

Renowned Bitcoin advocate and author of “Mastering Bitcoin” and “The Internet of Money.”

Certified Blockchain Expert (CBE) and Keynote speaker at major crypto conferences worldwide.

Over a decade of experience educating developers, investors, and enthusiasts on Bitcoin technology and investment strategies.

38 responses to “Mining Machines and Market Dynamics: Navigating Bitcoin Investment Strategies”

To keep it real, CryptoSlate’s clear Bitcoin dominance stats help cut through market noise remarkably well.

I personally recommend tracking changes in Bitcoin Improvement Proposals (BIPs) to see developers’ latest ideas and debates. It’s like watching the blueprint of Bitcoin’s future unfold, straight from the minds shaping it.

I personally recommend this rig for top-tier performance.

I personally recommend this service; they provided a competitive valuation for my used mining rig and made the whole process seamless.

I personally found that drawing Bitcoin links crypto theory with real art.

I personally recommend experimenting with different mining software—some are just more optimized for speed and efficiency on given hardware, significantly speeding up your Bitcoin mining process.

If you’re serious about crypto trading in 2025, I say give BTC futures a shot—they offer leverage and hedging tools that are hard to beat in traditional markets.

To be honest, the Bitcoin display items priced below $20 felt kinda flimsy in my hands; for something meant to last, invest a bit more.

I personally recommend watching Bitcoin’s halving as a masterclass in supply-demand dynamics. It’s a live textbook example of how programmed scarcity can influence asset prices and investor psychology.

I love how Bitcoin wasn’t created by a company but by an idea that grew into a global digital currency movement.

I suggest joining a mining community; collaborative effort increases 2025 Mexican gains.

Bitcoin runs on blockchain tech, which means no central authority controls your money—you’re your own bank, which is wild but also empowering once you wrap your head around it.

You may not expect, but the subtle Bitcoin symbols in some designs look elegant and sophisticated on any outfit.

By 2025, expect Ethereum rig prices to include smart cooling tech, which prevents overheating and extends hardware life, making your mining farm more sustainable.

I personally recommend it for its focus on profitability through efficient service flow.

To be honest, indicators like RSI and MACD are your best friends when judging Bitcoin’s late uptrend health.

Honestly, if you want a legit Bitcoin community forum download, find one that supports multi-language and has a strong moderation team – it makes the experience so much smoother.

You may not expect it, but even without stellar results, Bitcoin’s market potential keeps me interested; just gotta ride the waves carefully and watch trends closely.

You may not expect Uganda’s youth drives most Bitcoin adoption, showcasing impressive tech savviness.

2025 Mexico mining: The cartel demands a cut, affects projected bottom-line income.

In 2025’s context, mining machine hosting via long-term contracts delivers real value; the service’s emphasis on sustainability aligns perfectly with eco-friendly mining practices.

Bitcoin’s sharp drop surprised even seasoned traders watching daily candle closes.

Crude oil tanker routes, like the Strait of Hormuz, are vital chokepoints in international trade networks.

I personally recommend following key contributors on Zhihu who regularly post in Bitcoin threads. Their track records of accurate predictions and deep dives helped me shape better investment strategies.

You may not expect, but this Bitcoin info platform really digs deep into market trends.

Personally, I favor Bitcoin for portfolio diversity because it’s not correlated with traditional markets or gold prices, giving my investments a better balance against crashes and inflations.

To be honest, the hosting platform’s energy-efficient features have saved me a fortune on bills; highly recommend for newcomers.

American mining equipment in 2025 is a safe bet; the build quality is top-notch.

If you’re new, mining might sound daunting, but joining a reputable mining pool exponentially boosts your chances of earning Bitcoin without massive hardware investments.

I personally recommend $200 upfront in Bitcoin; it offers enough exposure without overwhelming your budget.

You may not realize it unless you trade daily, but Bitcoin’s circuit breaker mechanism is a game-changer, preventing runaway panic and allowing traders to re-assess rather than react impulsively.

You may not expect it, but major retailers such as Overstock and Newegg have embraced Bitcoin payments, showing how mainstream companies are cautiously warming up to crypto transactions, signaling a gradual but steady shift in how we shop online.

The live ticker for Bitcoin stocks is crisp, and switching between stocks is lightning quick.

I personally recommend following Bitcoin’s price alongside crypto news feeds; it gives you real-time context for why prices move the way they do.

This Bitcoin website’s customer service goes above and beyond, making problem-solving quick and painless every single time.

I personally think the stigma around Bitcoin criminals is increasing, as governments target crypto money laundering aggressively.

You may not expect large asset managers like BlackRock to dive this deep into Bitcoin, but their ETF actually corresponds to tangible BTC holdings, which is a game-changer for institutional adoption.

This hosting solution is efficient; I personally recommend it because it boosts hash rates significantly.