The world of cryptocurrency continues to evolve at breakneck speed, captivating tech enthusiasts and investors alike. Among the myriad of opportunities lies Bitcoin mining—a process that not only sustains the Bitcoin network but also offers a potentially lucrative investment avenue. As Canadian investors consider diving into this realm, the question arises: which Bitcoin mining machines stand out in a crowded market? The answer isn’t just about specifications; it’s about understanding the interplay between hardware performance, energy efficiency, scalability, and costs.

To embark on this journey, one must first grasp the fundamentals of mining machines. These specialized devices are designed to solve complex mathematical problems that validate transactions on the Bitcoin network, a process known as proof of work. The most effective machines—termed mining rigs—are powered by robust hardware capable of computational feats, with speed measured in hashes per second (H/s). When contemplating an investment in mining machines, Canadian investors should weigh factors such as energy consumption, cooling solutions, and price-to-performance ratios.

For those new to the mining scene, hosting mining facilities provide an attractive alternative to operating machines at home. Hosting services offer a seamless way to leverage high-performance miners in energy-efficient environments, eliminating concerns about home electricity costs and hardware maintenance. Imagine setting your mining rig in a state-of-the-art mining farm—while you focus on your investment strategy, expert technicians ensure optimal performance and efficiency. This option has gained popularity due to its simplicity and the reduced overhead it entails.

As one analyzes the burgeoning crypto landscape, Bitcoin remains the flagship cryptocurrency. However, other contenders like Ethereum (ETH) and Dogecoin (DOG) also deserve attention. While Bitcoin mining machines are optimized for SHA-256 algorithms, machines for ETH mining utilize a different approach based on Ethash algorithms. Thus, investing in a versatile mining setup—capable of accommodating different currencies—maximizes potential returns. Additionally, the recent updates on Ethereum’s shift to a proof-of-stake model shift the focus back to Bitcoin as the go-to choice for traditional miners.

Furthermore, the volatile nature of cryptocurrency exchanges plays a significant role in shaping investor confidence. Exchanges serve as gateways to trade Bitcoin and altcoins, creating fluidity and providing insights into market trends. Regularly analyzing price movements, understanding exchange fees, and recognizing liquidity are essential for capitalizing on investment opportunities. The interplay between mining operations and trading can create a hedge against market fluctuations, enhancing overall profitability.

Moreover, considering the regulatory landscape in Canada reveals another dimension for investors to ponder. Canadian regulations are becoming increasingly aligned with international standards, providing clarity for crypto miners and traders. Jurisdictions actively support the energy-intensive mining industry, especially where renewable energy sources offer significant cost advantages. In this context, taking advantage of localized incentives for clean energy can significantly enhance a mining operation’s sustainability and profitability.

As mining hardware advances, so too does the allure of passive income streams. With the development of cloud mining services, investors can rent hashing power from providers without the need for physical rigs. This service democratizes access to mining while eliminating upfront costs associated with purchasing hardware. However, caution is warranted as these services vary widely in terms of legitimacy and returns. Thorough research and due diligence are vital before entering contracts.

In conclusion, the quest for the best Bitcoin mining machines entails much more than simply buying the latest model on the market. Canadian investors must adopt a holistic view that encompasses hardware specifications, energy considerations, hosting options, and regulatory landscapes. With cryptocurrencies on a volatile journey, the knowledge of strategic investment and the versatility of being adaptable will yield the greatest rewards. Whether investing in mining rigs or renting cloud-based options, understanding the market landscape ultimately paves the way towards success in the exhilarating world of crypto mining.

One response to “Choosing the Best Bitcoin Mining Machines: Insights for Canadian Investors”

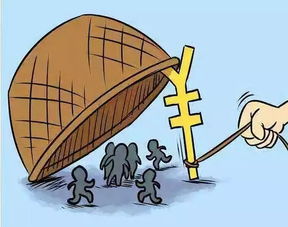

这篇文章巧妙融合了比特币挖矿机的技术细节、能源成本及加拿大税收影响,为投资者提供多样见解,帮助规避风险并抓住市场机遇,令人耳目一新。